This Week in Asia #8: Pockets of Growth in Southeast Asia

We are moving up our newsletter now to Wednesday weekly. In our 8th issue, the story is on Southeast Asia's macroeconomic growth from a McKinsey report taking a snapshot of the economies in Q3 2023 last year. We have seen the first steps by the Chinese government issued the largest cut to key mortgage rates, examples of Chinese tech giants looking for growth outside China, for e.g. JD bidding for Currys and the EV war's first casualty, China's HiPhi. Last but not least, we recommend the Hard Truths podcast by Vertex Ventures.

What we are reading this week

China

- China makes largest cut to key mortgage rate, first reduction since June a ‘step in the right direction’ to prop up economy by Luna Sun from South China Morning Post. Our Take: Initiating a move to alleviate household financial pressures and stimulate home buying, the Chinese government has deployed a key strategy. The People's Bank of China announced a reduction in the five-year loan prime rate (LPR) — a critical reference for commercial banks setting mortgage rates. This rate has been adjusted downward from 4.2% to 3.95%.

- Chinese ecommerce group JD.com considers offer for Currys by Ivan Levingston and Laura Onita from Financial Times. Our Take: This is a sign for all China tech giants looking offshore for growth, given their domestic growth has been maximized.

- China's HiPhi paused EV output and furloughs workers with future in doubt by Jill Shen from Technode. Our Take: The China EV low-volume car maker Human Horizons focused on the luxury segment and announced austerity measures. Increasing competition and slow growth have failed to extend their advantage in the premium EV market and now struggling in a cash crush. As a useful comparison, they delivered 8,000 units last year while their peers Li Auto and NIO delivered more than 376,000 and 160,000 units respectively, which is two orders of magnitude higher. While we are on that, BYD unveils their plan to boost brand image for global outreach and release new models of premium EVs (Source: Caixin)

India

- State of venture investments in India, according to Lightspeed by Manish Singh in TechCrunch. Our Take: Here are three key things which we think are important:

- Market Challenges: There are large volatility & regulatory challenges for the tech giants in India: Byju seeking new capital at a valuation slashed by 99% from its peak and Paytm's market capitalization falling below $3 billion.

- Over-Fundraising Concerns: The venture capital investments dropped from $33B in 2021 to $9B in 2023 and that is a 67% drop, with the number of investments halved from 2200 in 2021 to half in 2023 indicating a cooling market. We can infer that there is a lot of dry powder but they ran out of places to deploy their funds.

- India's position in the Global AI race: India lags in foundational AI research. In simple words, unlike China, they don't have a Lee Kai-Fu who can build a foundational large language model to compete the likes of Open AI, and the startups can dabble only in the applications layer. At least, Southeast Asia has a SEA-LION Large Language Model.

Japan, Korea, Taiwan & Hong Kong

- Seoul’s Big Switch: South Korea's semiconductor industry is in a tricky spot by Eliot Chen from The Wire China. Worth a read because South Korea is caught between a rock and a hard place with China and US due to the advanced chip sanctions.

- YouTube co-founder Steve Chen returns to Taiwan to tap tech talent, link island with Silicon Valley by Ralph Jennings from South China Morning Post. Our Take: Other than Taiwan's geopolitical risk, the island boasts a strong tech talent pool for not just hardware but software engineers as well and has world-beating companies like Foxconn and TSMC. Don't write them out.

Southeast Asia

- Malaysia’s KWAP announces first batch of investments under Dana Perintis by Backscoop. Our Take: We are not adding any brevity to what is summarized well. What we can add, is that there has been a fundraising activity to fund startups in Malaysia and relocation of tech teams to Malaysia due to special visa programs. VC firms in the region have recommended moving their tech teams.

- GoTo plus Grab: The merger that neither needs nor regulators don’t want by Jofie Yordan and Simon Huang. Our Take: That should have been done years ago when the regulators were less in an anti-trust mode. Of course, there were too many egos and bad blood to stop it from happening. Even if it happened, it would not bolster their chances of becoming profitable.

Australia

- Rippling opens Asia-Pacific HQ as its international expansion gears up by Catherine Shu from TechCrunch. Our Take: Expect a fight from the local payroll and HR software vendors with Rippling or be rolled over.

Recommendations

- Vertex Ventures Hard Truths Podcast: Vertex Ventures' podcast featuring the founders of their portfolio companies and their general partners.

- Jon Russell's Asia Tech Review is worth subscribing to, and it will take us here years to catch up.

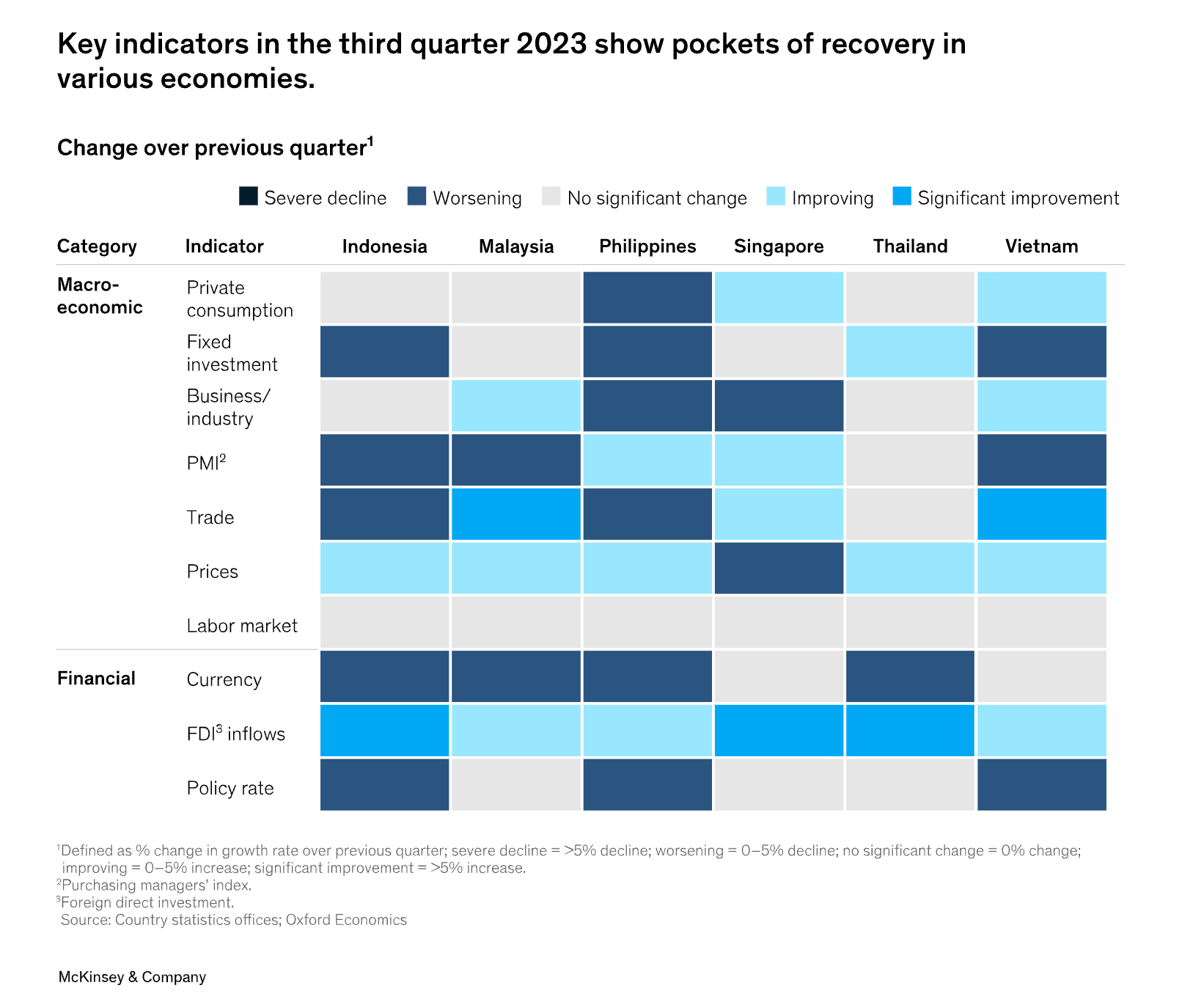

- Southeast Asia quarterly economic review: Pockets of growth emerge by McKinsey which provides a snapshot of the region's economic indicators in Q3 2023. The key chart is this one where you can see foreign direct investments flowing into the region and prices only worsened in Singapore but improved in the other Southeast Asian countries.

Your Daily Zen:

Lei Xing, one of our recent guests on Analyse Asia made an interesting observation on his X (formerly known as Twitter) account. Let us know if you have any counter-examples.

BYTON

— Lei 𝕏ing邢磊 (@leixing77) February 20, 2024

WM Motor

ENOVATE

AIWAYS

HiPhi

There is a common theme among these failed or failing Chinese smart EV startups: all of the founders had experience working at traditional legacy automakers.

Our Sponsor:

Do you manage your IT for distributed teams in Asia? You know how painful it is! Esevel helps your in-house team by taking cumbersome tasks off their hands and giving them tools to manage IT effectively. Get help across 8 countries in the Asia Pacific from on and offboarding, and procuring devices, to real-time IT support and device management. With their state-of-the-art platform, gain complete control of all your IT infrastructure in one place. Our team of IT support pros are keen to help you grow! Check out Esevel and get a demo today. Use our referral code “ASIA” for 3 months Free. Terms and conditions apply.

Our Ask:

If you like this newsletter, please like and share it. You can subscribe to our newsletter here or on our main site. Follow and subscribe on YouTube, Apple Podcasts, Spotify, X (formerly known as Twitter), Threads and TikTok.

Image Credits:

The image is generated with DALLE-3 from OpenAI by the following prompt: "Generate an image of a bustling city and a booming economy in Southeast Asia" and the Gen-ID is J7N4prC2uuc1XZs. The description of the image from ChatGPT: Here is the image of a vibrant and bustling city in Southeast Asia, depicting a booming economy. It includes towering skyscrapers, busy streets with various vehicles and pedestrians, and active shops. The skyline features cranes and new construction, symbolizing economic growth, while bright billboards and neon signs illuminate the cityscape, reflecting prosperity and technological advancement. The atmosphere captured is dynamic and energetic, typical of a rapidly developing urban environment in Southeast Asia.